Understanding Personal Loans:

Understanding Personal Loans are a popular financial tool used by individuals to address various financial needs, from consolidating debt to financing major purchases or covering unexpected expenses. This article delves into the key aspects of personal loans, including their types, benefits, application process, and what to consider before taking one out.

What is a Personal Loan?

A personal loan is a type of unsecured loan provided by banks, credit unions, or online lenders that can be used for almost any purpose. Unlike secured loans, personal loans do not require collateral, such as a house or car. Instead, they are granted based on the borrower’s creditworthiness and ability to repay.

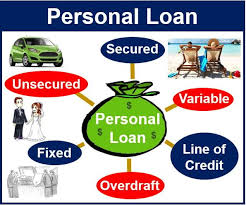

Types of Personal Loans:

Personal loans come in various forms, each suited to different needs and circumstances:

1. Unsecured Personal Loans: These loans do not require collateral and are granted based on the borrower’s credit score, income, and financial history.

2. Secured Personal Loans: These loans require collateral, which could be a savings account, certificate of deposit, or other valuable assets. Secured loans generally have lower interest rates because they pose less risk to the lender.

3. Fixed-Rate Loans: With fixed-rate loans, the interest rate remains the same throughout the loan term, providing predictable monthly payments.

4. Variable-Rate Loans: These loans have interest rates that can change over time based on market conditions, potentially leading to fluctuating monthly payments.

5. Debt Consolidation Loans: Designed to combine multiple debts into a single loan, debt consolidation loans simplify repayment and can potentially lower overall interest costs.

6. Co-Signed Loans: These loans involve a co-signer who agrees to repay the loan if the primary borrower defaults. Having a co-signer can help borrowers with less-than-perfect credit secure a loan.

Benefits of Personal Loans:

Understanding Personal Loans offer several advantages that make them an attractive option for many borrowers:

1. Versatility: Personal loans can be used for a wide range of purposes, including home renovations, medical expenses, vacations, and more.

2. No Collateral Required: Most personal loans are unsecured, meaning borrowers do not need to put up assets as collateral.

3. Fixed Interest Rates: Many personal loans come with fixed interest rates, allowing borrowers to budget their repayments more effectively.

4. Debt Consolidation: Personal loans can be used to consolidate high-interest debts, potentially reducing overall interest payments and simplifying the repayment process.

5. Quick Access to Funds: The application and approval process for personal loans is typically faster than for other types of loans, providing quick access to funds when needed.

The Application Process:

Applying for a personal loan involves several steps:

1. Determine Your Needs: Before applying, determine how much you need to borrow and for what purpose. This will help you choose the right type of personal loan.

2. Check Your Credit Score: Your credit score plays a crucial role in the approval process. Check your credit report for any errors and take steps to improve your score if necessary.

3. Research Lenders: Compare loan offers from different lenders, including banks, credit unions, and online lenders. Pay attention to interest rates, fees, and repayment terms.

4. Gather Documentation: Lenders typically require proof of identity, income, and employment. Gather necessary documents, such as pay stubs, tax returns, and bank statements.

5. Submit Your Application: Complete the loan application, either online or in person. Be prepared to provide personal information, including your Social Security number, address, and employment details.

6. Await Approval: The lender will review your application and credit history. Approval times can vary, but many lenders offer quick decisions.

7. Receive Funds: Once approved, the loan amount will be disbursed to your bank account. Depending on the lender, this could take a few days to a week.

Considerations Before Taking a Personal Loan:

While personal loans can be beneficial, it’s essential to consider the following factors before applying:

1. Interest Rates: Personal loan interest rates can vary widely based on your credit score and the lender. Shop around for the best rates and terms.

2. fees: Be aware of any fees associated with the loan, such as origination fees, prepayment penalties, and late payment fees. These can add to the overall cost of the loan.

3. Repayment Terms: Consider the length of the loan term and the monthly payment amount. Ensure that the repayment schedule fits within your budget.

4. Credit Impact: Applying for a personal loan can temporarily impact your credit score. Additionally, missing payments can harm your credit score, making it harder to obtain credit in the future.

5. Purpose of the Loan: Borrow only what you need and ensure that the loan serves a productive purpose, such as consolidating debt or covering necessary expenses, rather than funding discretionary spending.

6. Ability to Repay: Assess your financial situation and ability to repay the loan. Borrowing more than you can afford can lead to financial strain and potential default.

Alternatives to Personal Loans:

Before deciding on a personal loan, explore other financing options that might be more suitable for your needs:

1. Credit Cards: For smaller expenses, a credit card with a low interest rate or introductory 0% APR might be a better option.

2. Home Equity Loans: If you own a home, a home equity loan or line of credit (HELOC) might offer lower interest rates and tax-deductible interest.

3. Peer-to-Peer Lending: Online platforms connect borrowers with individual investors, potentially offering more favorable terms than traditional lenders.

4. Borrowing from Friends or Family: While potentially awkward, borrowing from friends or family can provide a low-cost alternative to traditional loans. Ensure that any agreements are clear and documented to avoid misunderstandings.

Conclusion:

Personal loans can be a versatile and valuable financial tool for addressing a variety of needs. By understanding the different types of personal loans, the application process, and the key considerations before borrowing, you can make informed decisions that align with your financial goals. Whether you’re consolidating debt, financing a large purchase, or covering unexpected expenses, a personal loan can provide the funds you need with manageable repayment terms. However, it’s essential to approach borrowing with caution, ensuring that you fully understand the terms and are confident in your ability to repay the loan responsibly.