Understanding Second Mortgage Rates:

When it comes to financing options, a second mortgage can be a valuable tool for homeowners seeking to access additional funds. However, understanding second mortgage rates and how they impact your financial situation is crucial before making a decision. This article delves into the essentials of second mortgage rates, their types, factors affecting them, and the implications for your finances.

What is a Second Mortgage?

A second mortgage is a loan taken out against the equity of your home, which is in addition to your primary mortgage. It allows homeowners to borrow money using their home’s equity as collateral. Second mortgages are often used for significant expenses such as home renovations, debt consolidation, or educational costs.

Types of Second Mortgages:

1. Home Equity Loan: This type of second mortgage provides a lump sum of money with a fixed interest rate and a set repayment term. Home equity loans are ideal for those who need a large sum of money upfront and prefer predictable monthly payments.

2. Home Equity Line of Credit (HELOC): A HELOC works like a credit card, offering a revolving line of credit that you can draw from as needed. It typically has a variable interest rate and allows you to borrow and repay funds multiple times during the draw period. HELOCs are suitable for ongoing expenses or emergencies.

How Do Second Mortgage Rates Work?

Second mortgage rates are generally higher than first mortgage rates. This is because second mortgages are riskier for lenders. In the event of foreclosure, the primary mortgage takes precedence over the second mortgage in claims on the property’s value. As a result, lenders charge higher interest rates to compensate for this increased risk.

Factors Affecting Second Mortgage Rates:

1. Credit Score: Your credit score plays a significant role in determining the interest rate for a second mortgage. Higher credit scores often qualify for lower rates, as they reflect a lower risk of default. Conversely, lower credit scores may result in higher interest rates.

2. Loan-to-Value Ratio (LTV): The LTV ratio is calculated by dividing the loan amount by the appraised value of the home. Lenders use this ratio to assess the risk associated with the loan. A higher LTV ratio, which indicates less equity in the home, may lead to higher interest rates.

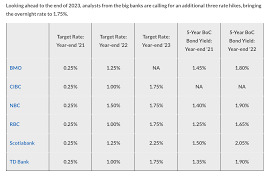

3. Current Market Conditions: Interest rates on second mortgages are influenced by broader economic factors, including the Federal Reserve’s actions, inflation, and market demand. Keeping an eye on economic trends can help you choose the optimal time to apply for a second mortgage.

4. Type of Loan: Fixed-rate second mortgages generally have higher interest rates than variable-rate HELOCs. However, the predictability of fixed-rate loans might be preferable for those who value stable monthly payments.

5. Loan Amount and Term: The size and term of the loan can also impact the interest rate. Larger loan amounts and shorter terms might come with different rates compared to smaller, longer-term loans.

6. Lender Policies: Different lenders have varying policies and rate structures. It’s essential to compare offers from multiple lenders to find the best rate and terms for your second mortgage.

Benefits of a Second Mortgage:

1. Access to Funds: A second mortgage provides access to significant funds for various purposes, such as home improvements, debt consolidation, or major expenses.

2. Potential Tax Deductibility: In some cases, the interest paid on a second mortgage may be tax-deductible. Consult with a tax advisor to understand the implications for your specific situation.

3. Lower Interest Rates Compared to Unsecured Loans: Second mortgage rates are often lower than those of unsecured loans, such as personal loans or credit cards, due to the collateral provided by your home.

Risks and Considerations:

1. Higher Interest Rates: Second mortgages typically come with higher interest rates than first mortgages. This can lead to higher monthly payments and increased overall loan costs.

2. Risk of Foreclosure: Defaulting on a second mortgage can result in foreclosure. Since the primary mortgage has priority in claims, you could lose your home if you fail to make payments on both mortgages.

3. Increased Debt Load: Adding a second mortgage increases your overall debt load. Carefully assess your ability to manage additional monthly payments and ensure that it aligns with your financial goals.

4. Closing Costs and Fees: Second mortgages often come with closing costs, fees, and appraisal charges. Be sure to factor these costs into your decision-making process.

Tips for Securing the Best Second Mortgage Rates:

1. Improve Your Credit Score: Before applying for a second mortgage, work on improving your credit score. Pay down existing debt, make timely payments, and check your credit report for errors.

2. Shop Around: Compare rates and terms from multiple lenders to find the best deal. Consider both traditional banks and online lenders, as they may offer different rates and terms.

3. Consider the Loan Type: Evaluate whether a fixed-rate loan or a HELOC is better suited to your needs. Fixed rates provide stability, while variable rates may offer initial savings.

4. Negotiate: Don’t hesitate to negotiate with lenders. Inquire about discounts, fee waivers, or rate reductions based on your financial profile and market conditions.

5. Understand the Terms: Carefully review the terms and conditions of the second mortgage, including interest rates, repayment schedules, and any penalties for early repayment.

Conclusion:

Understanding second mortgage rates and how they affect your finances is crucial for making an informed decision. While second mortgages offer access to valuable funds, they come with risks and considerations, including higher interest rates and potential foreclosure. By evaluating your financial situation, comparing lender offers, and understanding the implications of different loan types, you can make a choice that aligns with your goals and ensures financial stability.